When Cash Loses Value:

Why Hard Assets and Commercial Real Estate Are the Smartest Play Right Now

If you’ve been watching what’s happening in the economy, you can feel it, the dollar doesn’t stretch as far as it used to. The headlines change daily, but the story’s the same: more printing, more debt, more inflation.

Every time the government expands the money supply or bails out another sector, the cash sitting in your account quietly loses value. You might not see it instantly, but over time, the dollar buys less of everything that matters, gas, groceries, housing, energy. And while your savings account earns next to nothing, real assets, the things you can actually touch, keep marching higher.

This is exactly why investors with vision are shifting into commercial real estate, multifamily housing, gold, silver, and even Bitcoin. These aren’t speculative plays, they’re defensive positions against a weakening currency and a system that rewards the few while punishing the many.

Why the Dollar Can’t Hold Its Throne Forever

Every global reserve currency has an expiration date. History shows they last roughly 80 to 100 years before the world moves on to something else.

The Dutch guilder ruled trade in the 1600s.

The British pound dominated the 1700s and 1800s.

The U.S. dollar took over after World War II and has reigned since Bretton Woods in 1944.

That cycle is getting long in the tooth.

The rise of BRICS nations — Brazil, Russia, India, China, and South Africa — is no small threat. These countries are openly exploring trade outside the dollar system, developing new payment rails and settlement methods that bypass U.S. influence entirely. When the world no longer needs our currency to settle oil or trade, the dollar’s status will weaken, and so will the wealth of anyone holding too much of it.

The pattern is predictable. When a nation abuses its currency by printing and borrowing endlessly, investors flee to real assets.

Printing Money = Hidden Tax

Every new dollar created steals a fraction of purchasing power from the dollars you already own. It’s an invisible tax called inflation, and it’s the government’s favorite tool.

They can’t tax voters fast enough to cover trillion-dollar deficits, so they inflate their way out. On paper, wages might rise, but so does everything else. And by the time you realize it, your “safe” savings account is quietly bleeding value every year.

That’s why the wealthy park their money in assets that inflate with inflation, real estate, precious metals, and now even crypto.

Why Commercial Real Estate Beats Paper Assets

You can’t print more apartment buildings. You can’t create a new shopping center out of thin air.

Real estate is finite, tangible, and productive. It throws off cash flow every month. If you own the right property, you get paid whether the stock market is up, down, or sideways.

1. Cash Flow That Beats Inflation

Multifamily properties and shopping centers produce steady, recurring income.

Each tenant pays rent, and leases often include annual increases or CPI adjustments.

Unlike dividend stocks, these rents typically rise with inflation, protecting your income stream.

2. Appreciation and Leverage

On top of cash flow, real estate appreciates over time. Population growth, limited supply, and improvements in management or maintenance drive up value.

And because most real estate is leveraged, small appreciation in property value can yield outsized returns on your invested capital.

3. Tax Advantages

Depreciation, mortgage interest, and cost segregation all work in your favor, dramatically reducing taxable income, something you’ll never get from owning mutual funds or Treasury bonds.

4. Stability and Control

When you invest in a shopping center or multifamily asset, your returns depend on operations, not algorithms. There’s no high-frequency trader or hedge fund dumping shares at your expense. Your tenants sign leases, your property produces rent. That’s reality-based income.

Stocks and Bonds Are a Rigged Game

Wall Street is full of smoke and mirrors.

One week the market rallies on “AI optimism.” The next it crashes on “interest-rate fears.” Yet the insiders, the ones who already know the news before it breaks, rarely lose.

We’ve watched politicians time trades perfectly around major legislation. We’ve seen corporate executives dump shares before bad earnings reports. The average investor? They find out after the fact, when prices have already moved.

It’s not that the stock market can’t make you money, it’s that it’s not designed for you to win consistently. It’s a casino where the house always has the edge.

By contrast, a well-structured commercial real estate deal is transparent. You know the rent roll, the expenses, the financing, and the plan for growth. When structured properly, with reserves, quality tenants, and conservative leverage, it’s as close to a guaranteed yield as you’ll find in today’s environment.

You Don’t Need Millions to Get Started

Here’s the part most people don’t realize.

You don’t need to buy a shopping center on your own to benefit from these advantages.

Today, you can invest through real estate funds, syndications, or private partnerships, vehicles that pool investor capital to purchase large, income-producing properties.

You invest a fraction of the total cost, receive dividends from monthly cash flow, and participate in the upside when the property appreciates or sells.

It’s the same model Grant Cardone uses with his investors at Cardone Capital, except this approach can be even more accessible when structured correctly.

In short:

Your money is tied to real, cash-flowing property, not paper speculation.

You earn while you sleep.

You hedge against inflation and currency decline.

You build equity instead of watching your savings erode.

Why This Moment Matters

We’re entering a decade defined by currency instability, rising debt, and monetary manipulation.

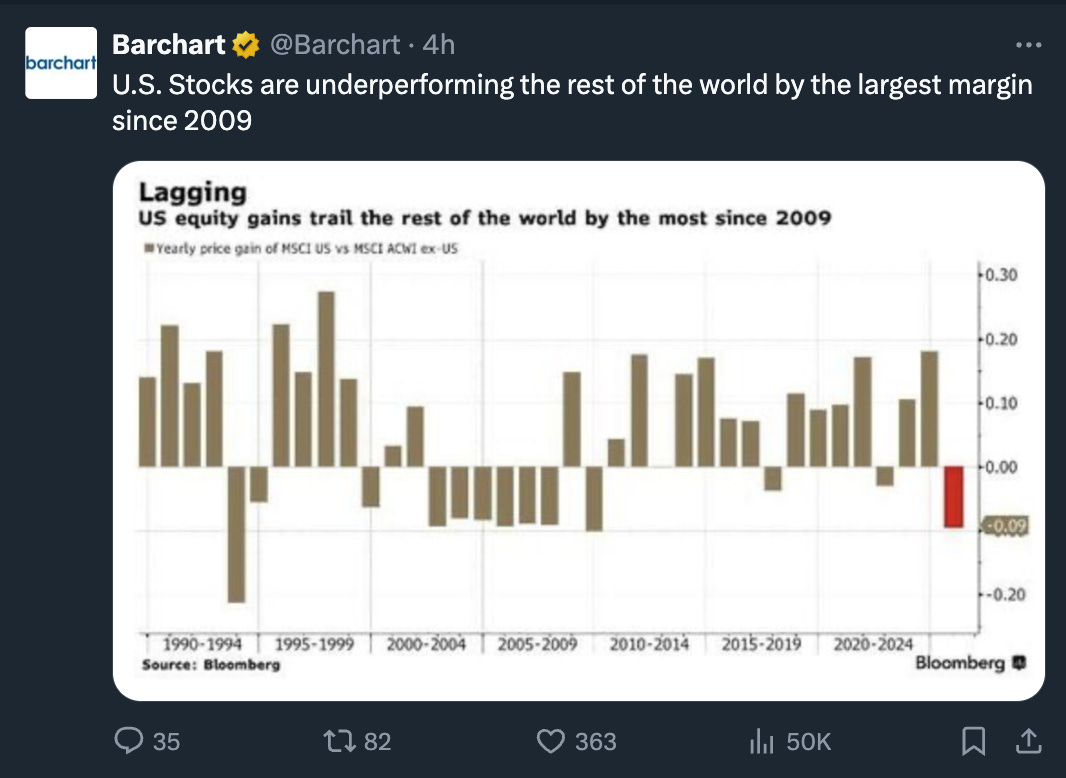

Traditional 60/40 portfolios, stocks and bonds, are no longer enough to protect purchasing power.

As the dollar weakens, the value of hard assets rises. And when those hard assets also generate recurring income, you create something truly rare: an investment that pays you to wait while it appreciates.

Commercial real estate is not just a hedge, it’s a strategy for generational wealth.

Final Thoughts

The world is changing fast. The dollar won’t be the world’s reserve currency forever, and paper assets aren’t the safe haven they once were.

Owning productive, income-generating hard assets, whether through direct ownership or a properly structured real estate fund, is how smart investors preserve and grow wealth when currencies lose credibility.

If you want to stay ahead of the curve, now is the time to start learning.

Subscribe for Early Access and Real-Time Insights

If you found this valuable, subscribe to this Substack for ongoing insights about commercial real estate, inflation, and the changing economic landscape.

Subscribers get:

Free weekly updates on commercial real estate strategies and market trends

Educational breakdowns of real property deals and how they’re structured

Early notifications when new investment opportunities arise, so you can be among the first to review and participate

When the next commercial acquisition comes along, our subscribers will be first in line to learn about it.

➡️ Subscribe now and start positioning yourself on the side of real assets, not paper promises.

Great article!