⚠️ This Is Not Investment Advice

Educational Market Framework for 11-20-25

The goal of this breakdown is to give you a clean, structured, repeatable way to analyze a potential SPY trade setup—without telling anyone what to buy or sell.

This is market research and volatility analysis only.

Today’s environment sits right at the intersection of elevated volatility, macro uncertainty, and a long-delayed Tier-1 economic release. Here is the full context for anyone studying short-term options structures.

📌 Market & Event Context

The delayed September jobs report finally dropped:

+119,000 jobs added (well above expectations)

August revised to a small loss

Unemployment rate: 4.4%

Government shutdown delays mean the BLS will not publish October’s household survey

Cross-asset volatility is elevated, SPY implied volatility remains high, and we classify this as a High Event-Risk environment.

This is typically when markets reprice very quickly.

One important additional note for today’s market context is the impact of Nvidia’s earnings. Several major outlets reported that Nvidia’s strong results and bullish forward guidance were the primary catalysts behind the early rally in U.S. equity futures, with the stock jumping more than 5% overnight. Because Nvidia is considered the bellwether of the AI build-out, its surprise upside move significantly boosted sentiment in the tech sector and contributed to the broader market’s early strength. This surge helped lift SPY futures before the opening bell, adding an additional layer to the volatility landscape beyond the jobs data and macro uncertainty. While the labor numbers created a high-risk environment, Nvidia’s earnings acted as a counterweight, temporarily stabilizing risk appetite and supporting the morning move higher.

📌 Regime & Trend Overview

Labor data is mixed. Jobs came in stronger than expected, but unemployment rose. That pushes the market into a choppy, mean-reversion-prone regime.

Additional signals:

Realized volatility: ~13–15%

Implied volatility: ~19–20%

When IV is this much higher than realized vol, it tells us the market expects larger moves than what has actually occurred.

ATR readings (1-day, 9-day, 14-day) are likely rising into today’s event window, signaling expanding price range potential.

📌 Volatility Edge (Educational Only)

30-day IV: ~19.67%

30-day HV: ~14.7%

IV Percentile: ~86%

That percentile alone tells the story:

Options are rich right now.

ATM IV has been slightly compressing, but it still sits at elevated levels due to macro uncertainty. This is one reason traders study short-vol structures during events—but high IV also means high risk if the market makes a directional surprise.

📌 Skew & Smile

Current readings show:

Put/Call IV ratio: ~0.92

→ Calls priced slightly higher than puts

→ Mild bullish skewWings appear overpriced relative to baseline diffusion models (typical before Tier-1 events)

The volatility smile is elevated and slightly convex, which is normal ahead of meaningful economic releases.

📌 Probabilistic Analysis (1-Day Window)

Using IV ≈ 19.7%,

you get approximate expected moves:

1σ: ~$2

2σ: ~$4

3σ: ~$6

Tail-event probability (3σ+) is roughly 0.5–1% given today’s macro backdrop.

Markov regime models suggest an elevated chance of a volatility regime transition—exactly what you’d expect when event-driven pricing dominates the tape.

Expected shortfall in an extreme downside move: $8–$10.

📌 Flow & Sentiment

Options flow heavy

IV Rank high (hedging or aggressive premium activity)

VIX elevated

Tech/AI correlation remains strong, and AI layoffs appear to be impacting market sentiment

This is not a stable backdrop.

It’s a reactive one.

📌 Systemic Correlation

SPY continues to move closely with mega-cap tech, AI-exposed names, and broad indexes.

Macroeconomic data and AI-driven labor trends feed directly into S&P 500 sensitivity.

Today’s environment is a blend of:

Labor data distortion

Shutdown-based reporting gaps

Elevated implied volatility

Rising unemployment

Stronger-than-expected job growth

Perfect recipe for a jumpy tape.

📌 Strike & Structure Framework (Educational Only)

This is NOT investment advice. This is simply what traders look at when evaluating potential setups.

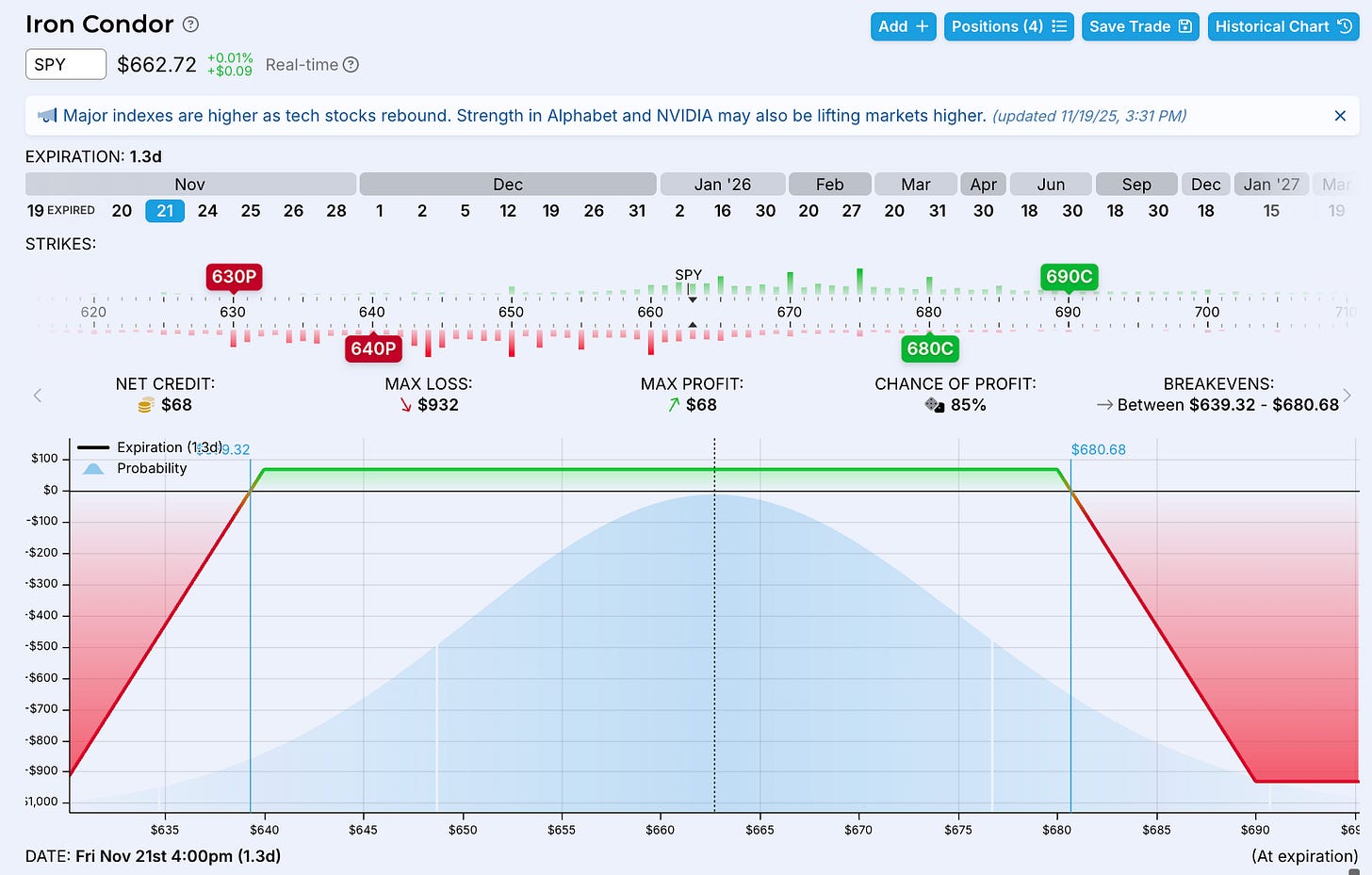

With DTE = 1, high IV, and a Tier-1 release, traders typically analyze defined-risk structures such as:

Iron Condors

Vertical credit spreads

Iron Butterflies

A 10–15 delta wing approach is a common analytical framework.

Example only — NOT advice:

If SPY is around $662

10Δ call ≈ $680

10Δ put ≈ $640

Defined-risk wings might be set ±10 points

Greeks tend to be:

Short gamma

Positive theta

Short vega

Delta-neutral if symmetric

Break-evens would sit near the short strike ± credit collected (example only).

This is the evaluation process, not a recommendation.

📌 POP / EV Table (For Study Only)

MetricNotesProbability of Profit~60–70% depending on width & IVEV ExampleCredit minus (Probability of loss × loss size)Tail RiskElevatedVol CrushPossible post-event

The main point:

Short-term defined-risk trades must be evaluated carefully because EV can be negative if credit is too small.

📌 Execution Framework (Educational Checklist)

This is simply what many traders study during volatile, event-driven windows:

Before the event:

Use defined risk

Reduce size

Widen wings

Focus on credit:width ratio

Keep orders to limit only

Risk management considerations:

Re-evaluate if price breaches a short strike

Re-evaluate if delta > 0.50

Time-stop before end of day

Consider early exit on vol crush

Profit-taking frameworks traders look at:

35% of credit

55%

70%

Optional hedge: small OTM put to cap tail risk (cost reduces credit).

Final Grade & Summary

Grade: B-

Not because the trade is good or bad—but because the environment contains both opportunity and instability.

Rich options

High event risk

Very short DTE

Uncertain labor data

Expanding ATR

Elevated IV percentile

It’s a fascinating setup to study.

And a risky environment to trade without experience.

⚠️ Final Disclaimer

This entire post is educational market commentary and volatility research only.

Nothing here is investment advice.

Nothing here is a suggestion to buy or sell any financial instrument.