Chopra Out, Bessent In: What’s Next for the CFPB?

Consumer protection agency faces an uncertain future.

CFPB Undergoes Significant Leadership and Operational Changes

Last updated Feb. 13, 2025

By Dennis Hendrickson

Latest as of Feb. 13, 2025:

The leadership of the Consumer Financial Protection Bureau (CFPB) seems to be in constant flux, with the role passing quickly from one individual to another.

Jonathan McKernan is reportedly set to be nominated as the next director of the CFPB by the Trump administration. If confirmed, he will become the fourth director in less than two weeks at the agency, which plays a central role in regulating the mortgage industry.

McKernan, who recently served as a member of the Federal Deposit Insurance Corporation (FDIC) board of directors, stepped down from that position earlier this week, according to Banking Dive. His nomination would mark the latest effort to stabilize leadership at the agency amid a period of significant transition.

The CFPB: A Watchdog Under Fire

The Consumer Financial Protection Bureau (CFPB) was created in 2010 as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act under the Obama administration. The agency was intended to be a consumer watchdog, holding financial institutions accountable for deceptive and predatory practices. Senator Elizabeth Warren was instrumental in its creation, claiming it would protect everyday Americans from financial exploitation.

However, recent events and historical scrutiny suggest the CFPB has faced challenges in fulfilling its mission. On Saturday, a little less than two weeks into his second term in the White House, President Donald Trump fired Rohit Chopra, who had served as the CFPB’s director since October 2021. While the Bureau boasted overseeing the return of approximately $6 billion to consumers from various financial institutions accused of fraud, predatory lending, and other violations, many consumers and experts have questioned its effectiveness.

A History of Consumer Concerns

Over the years, the CFPB has been criticized for its handling of consumer complaints. Numerous examples highlight its shortcomings:

One consumer was charged nearly $90 for a membership he never signed up for. Despite the CFPB being aware of such complaints, action only came after thousands of consumers had been affected.

The CFPB’s oversight mechanisms failed to uncover the Wells Fargo "upselling" scandal until it was exposed by the media.

The agency’s complaint database has been criticized for lacking transparency, often omitting details that could help other consumers avoid similar issues.

Recent Developments: Leadership and Operational Shifts

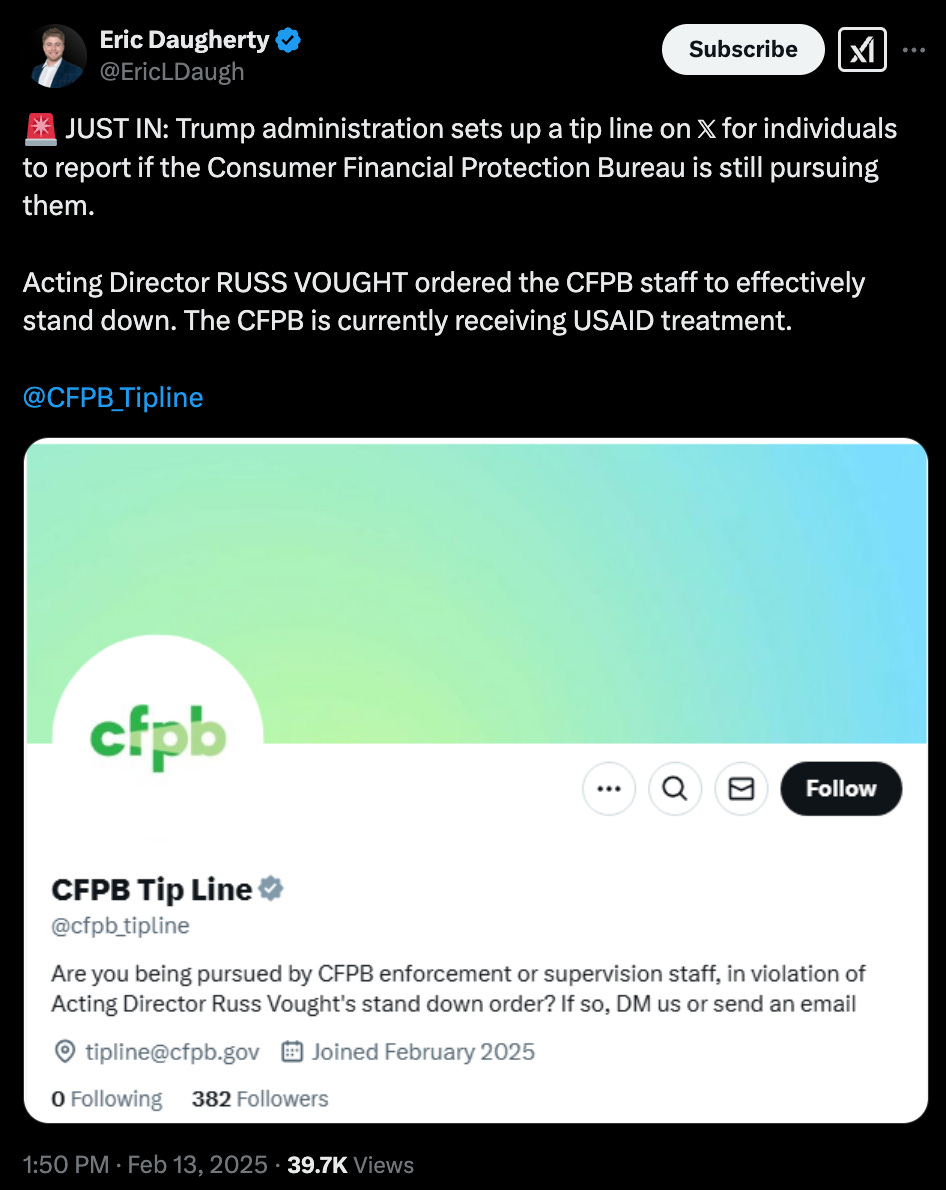

In addition to firing Rohit Chopra, President Trump’s administration has overseen significant staff cuts at the CFPB. According to NPR, dozens of CFPB employees were terminated under the direction of acting head Scott Bessent and White House Budget Director Russell Vought. Many of these employees were involved in enforcement and supervisory roles, leading to concerns about the Bureau’s ability to perform its core functions moving forward. (NPR)

Moreover, new allegations of mismanagement have surfaced. CNN reports that the CFPB has been criticized for awarding lucrative expert witness contracts to consultants without proper oversight during Chopra’s tenure. Critics argue this practice may have wasted taxpayer dollars while doing little to advance the Bureau’s mission of protecting consumers. (CNN)

According to AP News, White House Budget Director Russell Vought has indicated that additional funding for the CFPB will not be forthcoming, citing an existing balance of $711.6 million as sufficient for its scaled-back operations. (AP)

Questions About the Bureau’s Future

With hedge fund manager Scott Bessent now serving as the CFPB’s acting director, the agency’s activities have largely been halted. Bessent’s first directive included pausing all new rules, enforcement actions, and even communication with the public. Industry observers see this as part of a broader effort to diminish the Bureau’s influence. (US News)

Additionally, critics argue that the CFPB’s effectiveness has been hindered by political interference and its inability to respond promptly to consumer complaints. US News highlights that while the CFPB has historically returned significant sums of money to consumers harmed by financial misconduct, the current halt in operations leaves many wondering whether the Bureau will continue to play a meaningful role in consumer protection.

Balancing Consumer Protection and Industry Oversight

The CFPB’s critics have long argued that the Bureau imposes overly aggressive regulations that stifle financial innovation, while supporters maintain that its work has been essential in holding financial institutions accountable. During its existence, the CFPB claims to have returned more than $20 billion to consumers through enforcement actions against financial misconduct. However, experts now worry that the pause in CFPB operations could embolden financial institutions to engage in unethical practices without fear of repercussions.

Questions About the Bureau’s Future

With hedge fund manager Scott Bessent now serving as the CFPB’s acting director, the agency’s activities have largely been halted. Bessent’s first directive included pausing all new rules, enforcement actions, and even communication with the public. Industry observers see this as part of a broader effort to diminish the Bureau’s influence. (US News)

Additionally, critics argue that the CFPB’s effectiveness has been hindered by political interference and its inability to respond promptly to consumer complaints. US News highlights that while the CFPB has historically returned significant sums of money to consumers harmed by financial misconduct, the current halt in operations leaves many wondering whether the Bureau will continue to play a meaningful role in consumer protection.

The End of the CFPB as We Know It

As the CFPB undergoes leadership changes and operational halts, its future appears increasingly bleak. Once heralded as a groundbreaking watchdog for consumers, the Bureau is now a shadow of its former self. Critics argue that the combination of leadership shifts, mass firings, and a freeze on operations signals the beginning of the end for the agency. Experts contend that without meaningful enforcement or the ability to carry out its mandate, the CFPB’s mission has effectively been dismantled. For many, this marks the conclusion of an experiment in centralized consumer protection that—while ambitious in its inception—has ultimately failed to withstand the pressures of political and institutional challenges.